What Do You Need To Register As A Sole Proprietorship In California

With a gross state product of $3.16 trillion, the state of California has the largest economy in the United states. In fact, if California was a sovereign nation, and then information technology would be the fifth-largest economic system in the world.

In that location are four.viii million micro-enterprises in California, which comprises 99.8% of all businesses in the state. These apply 48.5% of the private workforce, which is approximately 7.2 1000000 people.

In fact, California is the largest and wealthiest state in the United states of america, with some of its major industries existence technology (Silicon Valley). agriculture/farming, amusement (Hollywood), as well as millions of modest businesses.

Additionally, California is a hotbed for startups and top corporations and ranks #31 on the Forbes Best States for Business organization Listing. Some of the major companies based in California are Apple and Google, to name just two out of the several.

With the vast opportunities that California presents to all businesses, registering and starting a business in California is an bonny proposition for those of the entrepreneurial mindset and wanting to earn increasing and abiding revenue, with most possibly loftier returns on investment and healthy financial statements.

Automate Accounting, Tax Compliance and Managment of Business Financial Transactions

Go Deskera Today

However, California has complex state regulations and requirements of credit facilities that whatsoever and every business have to comply with and meet in society to become a registered business in California.

This article will take yous through all the steps for registering your business in California and will thus encompass the post-obit 13 steps as well as other related areas to the topic:

- Step ane: Select Your Business Structure

- Footstep 2: Choose Your Business concern Name

- Step 3: Register Your Business concern

- Step 4: Obtain Your Federal Employer ID Number (FEIN)

- Step five: Open up Your Business organisation'due south Bank and Credit Accounts

- Pace 6: Ready an Accounting System

- Step 7: Obtain Licenses and Permits

- Step 8: Register with the EDD

- Step nine: Hire Employees (if applicable)

- Pace ten: Obtain Business Insurance

- Step 11: Organize and Systematize

- Footstep 12: Branding and Marketing

- Stride 13: Annual and Ongoing Requirements

- How Can Deskera Assistance You?

- Key Takeaways

- Related Articles

Step ane: Select Your Business Structure

After your business organization plan is finalized, you should focus on selecting the construction of your business in California. While selecting a business construction, you lot should consult a individual attorney or a tax advisor as she or he volition exist able to guide you through the requirements of each business concern entity and which one of them will meet your business needs. They will too inform y'all of the legal obligations that you need to fulfill before you are able to commit to a business structure.

Some of the major types of business entities bachelor in California are:

- Corporation

- Limited Liability Visitor

- Limited Partnership

- General Partnership

- Limited Liability Partnership

- Sole Proprietorship

- DBAs

Out of these, Corporation or "Corp" is one of the popular business structures chosen past the businesses in California. Information technology is a separate entity that provides liability protection to its owners. This business organisation structure includes directors, shareholders, and officers. Though Corporation is a more complex business structure than the DBAs, it is an ideal choice for profit-earning companies. Some professions are required to form a "Professional person Corporation" or PC similar doctors, lawyers, architects, etc.

Another popular business organisation structure chosen by businesses in California is LLC, which is a separate entity that provides liability protection to its owners. When compared with the Corporation construction, LLCs are easier to manage and are even taxed less. It is because of these two key features that LLC is often preferred over DBA as well as Corporation business construction.

DBA or Doing Business As or Fictitious Business concern Name or Trade Proper name is oftentimes used as an operating name to simplify the legal name or differentiate from other businesses with similar names. DBAs are also used to manage multiple businesses under one LLC or Corporation. For example, California Dreaming LLC could register a DBA like California Car Spa for a motorcar wash business and California Dreaming Classic Autos for a custom car shop. By doing and so, information technology will not have to go through the trouble of forming ii separate LLCs or Corporations.

Notation: To establish a sole proprietorship business organisation in California, you are not required to file whatever organizational documents with the land.

The aforementioned is the instance with general partnership businesses in California. However, it is recommended to have a written partnership agreement that would be helpful in case of disputes amongst the partners.

However, in the example of a limited liability partnership business in California, you lot will be required to file a registration with California'south SOS.

Step 2: Choose Your Business Proper name

After businesses in California have called their business construction, they should focus on choosing their business name. Choosing a concern proper name is a complex task every bit the incorrect name can bring several legal and business problems at your threshold. While you tin alter your business proper name at a later date, it is easier the fewer times you practice it.

Some of the steps you must fulfill for choosing your business name and before searching the California state databases for it are:

- Make sure you have covered the basics- Your business name should exist easy to sympathize/pronounce while also being unique. Information technology should be a representation of your intended brand positioning statement and should ignite customer involvement and customer loyalty when said out loud or repeated. In fact, a unique yet piece of cake-to-understand name is one of the keys to having a college number of sales referral.

- Search the web- Once yous have a few ideas for your proper name of the business in California, you should search the spider web for information technology. By using browsers like Google, DuckDuckGo, Bing, etc., you lot would be able to do the preliminary bank check for any potential conflicts, especially in your state or local jurisdiction. (Note: If your business in California is to operate nationally or even internationally, then information technology is even more than important to accept a unique business name. This should cover many cases where a visitor proper noun is beingness used merely non officially trademarked.)

- Practise a trademark search- Using the US Patent and Trademark Office (USPTO), y'all should practice a trademark search of the concern name you prefer. This will be a very good indicator of whether your name has any conflicts or not. (Notation: While doing a trademark search for the name of your business concern in California, you should also search for misspellings, plurals, variations of spelling, sound-alikes, and other versions of your chosen name to make sure that it is not already registered.)

- Make sure your company name choice is available- You tin do this by searching the California Secretarial assistant of State'southward business entity database. Here likewise, make sure to search for variations of spelling, misspellings, and plurals as the state may reject a proper noun that is too similar to an already registered one. If this is the case, you would have to first your process of choosing the proper noun of your business concern in California all over once more.

Restrictions on California Business Proper name and Concern Purpose

Some of the restrictions that California concern names must adhere to are:

- Your company name must include the correct corporate identifier: like, Corporations should use "Corporation", or "Incorporated" or an abbreviation suggesting the same.

- Your business concern name may not comprise words like "bank," "trust," "trustee," and shall not contain words such as "insurer" or "insurance visitor" or any other words suggesting that it is in the business concern of issuing policies of insurance and assuming insurance risks.

- The business concern purposes which will require the germination of a "Professional Corporation" or PC are:

| Accounting |

| Acupuncture |

| Architecture |

| Chiropractic |

| Clinical Social Work |

| Dentistry |

| Law |

| Spousal relationship, Family unit, and Child Counseling |

| Medicine |

| Voice communication-Language Pathology and Audiology |

| Nursing |

| Optometry |

| Osteopathy |

| Pharmacy |

| Physical Therapy |

| Doc Assistants |

| Podiatry |

| Psychology |

| Shorthand Court Reporters |

Step 3: Register Your Business

Each land of the United States has its own specific requirements for registering a business organisation. Afterward you accept called your business structure and business organisation name, the requirements that you volition take to fulfill to register your business organization in California are:

How to Grade an LLC in California

To form an LLC in California:

- File Form LLC-1 (Manufactures of Organisation) with the California Secretary of Country LLC Sectionalisation.

- Once the articles are filed and approved, yous will need to properly organize the LLC, even if it is a "1 person LLC" past holding an "Organizational Meeting." Through this coming together, contributions from the members will be taken, fellow member certificates will be issued, the visitor operating agreement will exist adopted, and many such decisions and documents will be prepared.

How to Form an Comprise in California

- File Form ARTS-GS (Articles of Incorporation) with the California Secretary of Land Corporation Division.

- Concur an "Organizational Meeting" to determine the percentage of ownership for each shareholder. In this meeting, tasks like opening a visitor bank account, paying back pre-incorporation expenses, electing an S-corporation state, and other such tasks would be resolved to be washed.

- Corporations tin elect S-corporation status with the IRS by filing IRS Grade 2553.

Annotation: When registering a new company with California's Secretarial assistant of State, information technology can take several weeks to file the paperwork. Ane of the ways by which you can speed upwards this process is by getting your documents hand-delivered to them or to i of their field offices and besides by paying additional fees.

How to File a DBA in California

DBAs are filed with the canton, and to practice so, you would accept to contact your local County Recorder to discover out the exact forms you demand to submit as well as the submission process. To find your local county recorder's office, search "YOUR COUNTY county recorder."

- To register your DBA, obtain and file the correct forms with the count. (Note: Some counties let yous search the name and register online. Others require the registration form to be notarized.)

- Publish a notice in an canonical newspaper. The county would be able to guide yous with the identification of approved newspapers. The discover'due south publication frequency should be at least one time a week for four sequent weeks. After the fourth publication, the newspaper visitor should ship you a Proof of Publication as a signed affirmation indicating dates of publication in their newspaper.

- Within 30 days after the fourth publication, you should file the Proof of Publication with the County Clerk's Function.

Optional Considerations When Registering a Business organization in California

When registering a business organization in California, several people list their dwelling or business address on the Articles of Organization, thereby condign the victim of lots of junk mail every bit this accost becomes a public record. To avoid such issues, you can hire a professional Registered Agent who will provide their address on the Articles of Organization and frontward whatsoever important documents to you.

Having a registered amanuensis is besides convenient if y'all have to move someday, as yous will not accept to file forms or pay fees with the government. You would just have to update your address with your amanuensis.

Step 4: Obtain Your Federal Employer ID Number (FEIN)

Your Federal Employer ID Number (FEIN) is similar your Social Security Number for your company. The FEIN is mandatory if your business organisation construction is Corporations and LLCs but optional in the case of DBA business structure unless y'all have employees, in which case it becomes mandatory.

However, if your business organization structure is DBA and you do not go your EIN, then you would be forced to apply your social security number on several documents, making you lot vulnerable to identity theft. Thus, by getting your EIN, you lot would exist able to forestall that.

Note: To obtain an EIN, you can utilize online with the IRS or via IRS Form SS-4.

Step 5: Open Your Business's Banking concern and Credit Accounts

It is required that yous keep your business and personal finances separate, and one of the ways of ensuring that is past opening a business banking concern and credit account. Corporations and LLCs are required to operate these types of accounts, but they position your company for favorable loans and lines of credit.

Typically, the documents that you will need to open your business organisation bank account are:

- Filed paperwork

- EIN

- Visitor resolution signed by the owners, members, directors, officers, etc. that volition authorize your visitor to open an account.

Pace 6: Fix an Bookkeeping System

After fulfilling all the previous steps, you should set up an accounting and record-keeping arrangement while also acquainting yourself with the taxes that are applicable to your business in California. This would depend on diverse factors like your business concern construction, the number of employees, the manufacture of your business, the revenue of your business organisation, etc.

Later on locating your tax information, you should also file them. To do and so, you should ensure that you have all the necessary paperwork for the following country and federal agencies and programs:

- California Franchise Taxation Board (FTB)

- State Board of Equalization (BOE) to obtain a seller'due south permit

- Land of California Employment Evolution Department (EDD)

- Internal Revenue Services (IRS)

Mostly, information technology is required that the company documents be kept for three years. This should likewise include a list of owners and addresses, copies of all germination documents, annual reports, financial statements, amendments, or changes to the company. In the case of tax and corporate filings, all of those documents should be kept for at to the lowest degree three years.

Note: If you are a sole proprietorship business in California, you will have to pay state taxes on your business income as function of your personal country income revenue enhancement return and the tax subclass that you are a part of.

In the case of partnership business in California, partners volition have to pay state taxes on partnership income on personal taxation returns and equally per the tax bracket that they fall in. Additionally, California partnerships will also have to file Form 565- Partnership Return of Income.

In the case of LLCs, their members volition have to pay state taxes on their share of LLC income on personal taxation returns. In add-on to that, the LLC volition also have to file an additional state tax form. Which specific class will exist used by the LLC for the same will depend on its classification for federal tax purposes. LLC businesses in California are also required to file a biennial statement of information.

In the case of corporation business concern in California, the shareholders will have to pay country taxes on their dividends from the Corporation. A shareholder-employee with a bacon will also take to pay country income taxation on her or his personal state tax return. On meridian of it, the Corporation itself will be bailiwick to California corporation taxes. Lastly, the corporations must file an annual statement of information with the California SOS.

Step 7: Obtain Licenses and Permits

Some of the businesses in California might need to obtain a license or a permit to go your company authorized to do business organization in your city or county. Unremarkably, this too involves registering for country taxes and permits (the city may crave them as office of the concern licensing process).

If, however, you lot are unsure whether you are legally obliged to get a license or a permit and its requirements for your business in California, then you can resort to using the Gold Standard for Permit Assist CalGOLD and the Section of Consumer Affairs.

Some of the common licenses and permits include:

- Business License

- California Seller'southward Permit

- Warning Allow

- Building Permit

- Revenue enhancement Permit

- Health Permit

- Occupational Permit

- Signage Permit

- Zoning Permit

Note: Every business in California must obtain a full general concern license from the urban center where the business organization is located, and in the case of unincorporated sections of the state, from the canton where the business concern is located.

Step viii: Register with the EDD

To annals as an employer with the EDD, i.east., Employment Evolution Department, you lot will need the following information most your business:

- FEIN

- Business Type

- Legal Name

- DBA

- SoS Account Number

Once you are successfully registered as an employer, you volition exist assigned an account number known equally the Land Identification Number (SEIN) past the EDD, which will exist unique to your concern. The SEIN tin then exist used by you to file and pay your state payroll taxes in the futurity.

You would also exist assigned an unemployment insurance tax rate by the EDD, which is a state-specific tax whose rates can change depending on your business concern'south employment history. For example, if lots of your one-time employees have filed a claim to collect unemployment insurance, so your taxation charge per unit for the aforementioned will increment.

Note: Some cities and counties in California require you lot to register for payroll as well. Then make sure you check whether you are liable to comply with these needs or non.

Step ix: Rent Employees (if applicative)

If your business organization in California is as well going to rent yourself or others as a full-time or part-fourth dimension employee of your company, then you will need to register with the appropriate Country Agencies or obtain Unemployment Insurance, or Workers Compensation Insurance, or both.

You should as well consider getting group health insurance for your employees with guidance from a health insurance banker. Such company-sponsored employee benefits volition reap benefits to your company in the class of beingness able to retain meridian talents, manage workplace stress, and have a bottom employee turnover ratio.

Step 10: Obtain Business organisation Insurance

It is logical to have your business protected against unforeseen circumstances that tin can have detrimental effects on your business, its financial KPIs, and even on its revenue, with an increase in ratio of operating expenses over operating income.

To practice so and save your business from such expenses, you should go business insurance. While at that place are many types of insurance for businesses, they are ordinarily packaged as "General Business concern Insurance" or a "Business Possessor's Policy." Such insurances can embrace everything from production liability to company vehicles, thereby providing an extra level of protection.

Step xi: Organize and Systematize

One time you have gotten your business concern in California registered, you lot should organize and systematize it in such a way that even if someone is going to ruin it for yous, they should face no difficulty.

Such an organization and systematization involves choosing the method to process orders, pay bills, carry out payrolls and pay employees, pay taxes, maintain your permits, ensure positive customer feedback and strong customer retention, deliver proactive customer service, and and so on.

All of these aspects will help in making the operational aspect of your business as automated and efficient every bit possible while letting y'all focus more on growing and developing your business organisation farther.

Footstep 12: Branding and Marketing

One time your business concern in California is registered and set up, you should start focusing on spreading the discussion about your business organization to your potential customers. To do and then, you demand to make a marketing plan that will cover your branding and make marketing efforts and different marketing strategies like content marketing, performance marketing, Instagram marketing, sustainable marketing, digital marketing, and other such forms of marketing which are in line with your brand image and marketing objectives.

Through your marketing efforts, you would exist reaching your heir-apparent personas and convincing them to purchase your product or services. Successful branding and marketing campaigns can exist ensured through regular monitoring of marketing KPIs and subsequent changes in marketing strategies. This will assistance in increasing your gross profit besides as your net profit and net turn a profit ratio.

In fact, it might as well assist in improving your cash flow and making your financial statements like profit and loss statements, income statements, and residuum sheets healthier. A branding and marketing campaign, when carried out properly, volition likewise encourage returning customers and increment sales.

Step 13: Almanac and Ongoing Requirements

One time your concern in California is registered, some of the annual and ongoing requirements that you should keep in mind and comply with are:

- DBA- Your fictitious business name should be valid for five years (unless yous change the company name or other information listed on the FBN), at which signal you volition need to renew it with the county.

- LLC- An Initial Statement of Information needs to be filed past Californian Companies within 90 days of filing articles of system. Additionally, you must likewise file Biennial Statements of Information with the California Secretarial assistant of Country biennially by the end of the month of your business concern' anniversary, in addition to general taxation. California also requires a minimum $800 fee to the Franchise Tax Board each twelvemonth; however, businesses in California get an exemption for the same in their first twelvemonth in business. Lastly, depending upon the nature of your business concern, you might fifty-fifty have to go your license or permit renewed periodically.

- Corporation- Your business must proceed its corporate records at its principal place of business concern. In one case every two years, by the company'due south anniversary engagement, an officer of your Corporation must file an annual written report. LLCs and Corporations will pay a filing price of $300.

How Can Deskera Help You lot?

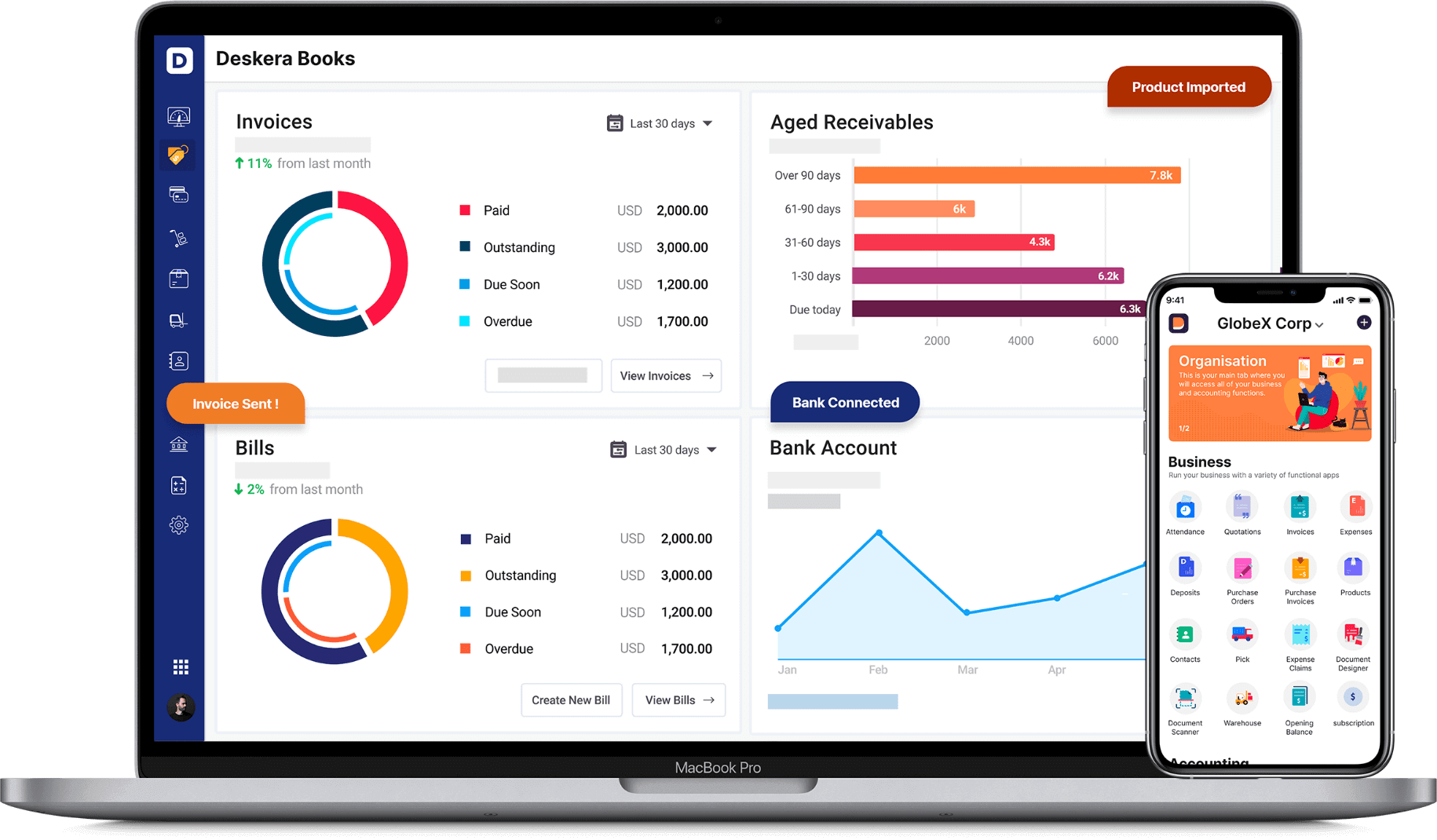

Deskera Books is cloud-based, online bookkeeping software designed to manage and automate concern finance transactions invoices, bills, inventory, bank connect, approval flows, reporting, and taxes, to mention a few core features.

Deskera Books will practice all the heavy lifting for you, like managing your chart of accounts, periodical entries, and general ledgers, while letting you focus on running your business. One of the fundamental features of Deskera Books is that it comes with pre-configured accounting rules, tax codes, and invoice templates, amongst many other things.

In fact, even setting up your business in Deskera Books is like shooting fish in a barrel equally you will have to sign upward using your email address or social hallmark account. Fifty-fifty your accountant can utilise the system one time y'all take invited them to do then through their email address.

Automate Accounting, Taxation Compliance and Managment of Business Fiscal Transactions

Get Deskera Today

Key Takeaways

Registering a business organization in California is a long and slow procedure, simply once you know all the steps and requirements for the aforementioned, along with a proficient team to help you, which also includes a legal and financial advisor, yous would exist practiced to get.

Remember, getting your business organization registered correctly is the key to permanently sorting out one of the major aspects of your business and even setting upwards a base for its growth, development, and success.

Even so, there are some aspects that volition require periodical renewals like licenses or submission of data to the relevant state authorities like revenue enhancement filings. This can get tedious, but having software like Deskera Books which largely automates accounting, auditing, and taxation compliance, will greatly help y'all.

So, what are you lot waiting for? Get your business in California registered by using this commodity every bit your guide, and pursue your aspirations.

Related Manufactures

11 Things Every Startup Needs to Include in Their Kickoff Business Program

Start of all, a huge congratulations to yous as y'all are all set to accelerate thenext big pace for your startup! The side by side big step direct highlights writing a "Business organisation Program"[https://www.deskera.com/blog/business-programme/] that is considered nearly vital tothe business'due south wellness. Information technology is the stage whe…

Everything You Need to Know About Employer Identification Number or EIN in the U.S.A

Planning to start your business organisation in the United States? So, you must apply for an Employer Identification Number or EIN! Acquiring an Employer Identification Number, or EIN is the very first pace informing a business in the United States. It helps to place your business. Starting a concern …

A Guide to U.s.a. Sole Proprietorship Taxes

Is the prospect of filing taxes in 2022 for your sole proprietorship businessstressing you out? Do you want a amend understanding of the U.s.a.'south state andfederal government taxes that you would be required to pay as a sole proprietorto ensure consummate tax compliance? If yous are here, it means tha…

How Practise Limited Liability Companies (LLCs) Pay Taxes in Us?

Between 2004 and 2014, IRS statistics have recorded a 66% increase in thedomestic Limited Liability Companies (LLC)[https://world wide web.deskera.com/web log/limited-liability-company-llc/]. Mail information technology, LLC'spopularity has only increased over the years. This is considering choosing between dissimilar business entit…

How Do I Pay Myself equally an Possessor of a Multi-Member LLC?

Starting your business organization is an exciting venture. Only one crucial part of thisjourney is to know how yous're going to pay yourself. Once the money startsrolling in, you demand to know how do you get it out of your LLC? Well, there aredifferent options depending on the type of LLC you own. Read on to kn…

How To Gear up Accounting And Tax Service For Your Partnership?

Partnership bookkeeping is the cornerstone of your financial reporting in apartnership. It allows you to track the fair value of all avails and income,leading to financial decisions. Allow'due south imagine a scenario. You started a partnership to run your new business organisation.You and your partner decided to buy a co…

The Best Banks for Small Businesses in U.s.a.

Financial direction is a very crucial factor that should be one of the toppriorities to keep the business running. But when it comes to small businesses,financial management requires a bit more care and surveillance due to thecapital constraint. It is very important for a small-scale business to keep …

What Do You Need To Register As A Sole Proprietorship In California,

Source: https://www.deskera.com/blog/business-in-california/

Posted by: kaiseradioncy.blogspot.com

0 Response to "What Do You Need To Register As A Sole Proprietorship In California"

Post a Comment